Posted on:

Featured, Insights, Latest Thinking, Proxy Season Updates, Sustainability & ESG, What's NewOver the last few years, boards of directors have expanded their oversight function more broadly into environmental, social and governance (ESG) matters. Moreover, the pandemic and the social and racial reckoning, following on the heels of the #MeToo movement, have brought a brighter spotlight to ESG concerns, particularly human capital management (under the “S” in “ESG”). A growing number of institutional investors, the SEC, various organizations and other stakeholders are calling for increased ESG disclosure, with several commentators suggesting specific disclosure frameworks and metrics, as well as greater transparency on the board of directors’ oversight of ESG. In turn, boards are reviewing ESG-related risks and opportunities, considering the connection between ESG and a company’s long-term strategy and enhancing how ESG information is reported. As we discuss in this post, boards should also review how they delegate oversight of ESG matters.

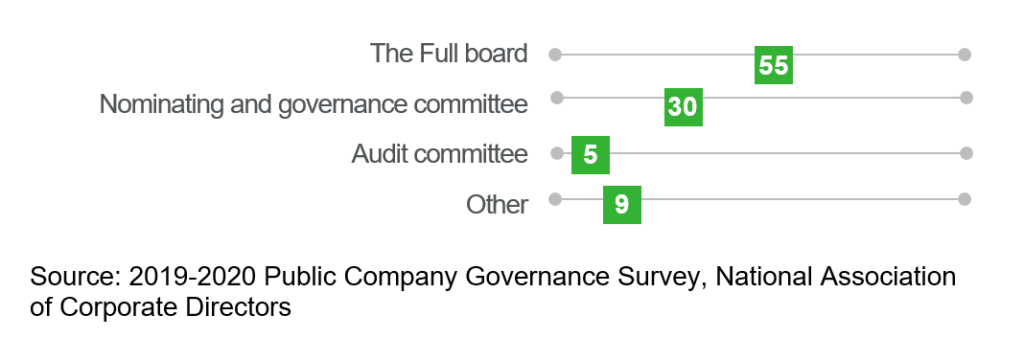

As directors continue to focus on ESG, boards are formalizing their oversight of ESG issues at the full board and committee-level. As noted in the chart below, a majority of boards are primarily maintaining the oversight responsibility for the company’s approach to ESG matters at the full board level.

Primary Location for ESG Oversight (Percentage of Boards)

Given the desire to connect ESG matters to a company’s long-term strategy, the full board would be best suited to oversee the company’s approach to ESG oversight, including ESG-related risks, and should receive regular reports and updates on the company’s efforts as they relate to the company’s goals and strategy. Further, the full board would be well-positioned to ensure that the company’s ESG message and reporting is cohesive and communicated through the appropriate platforms in line with the company’s purpose and stakeholder interests.

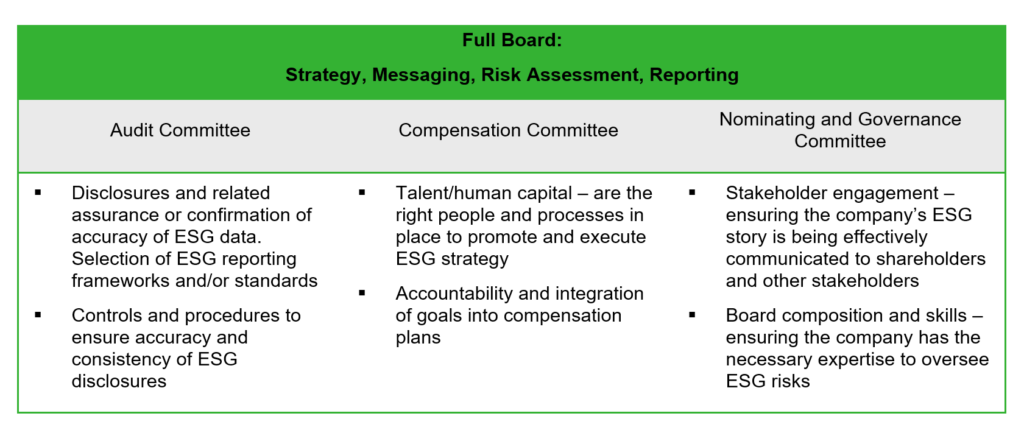

Board committees also may have a significant role to play in ESG oversight, as certain matters and responsibilities relevant to ESG oversight can be delegated to board committees, as appropriate, to steward and report back to the full board. If appropriate, a suitable allocation of responsibilities and focus at a high-level relating to oversight of ESG matters across committees could include:

What Should Boards of Directors Do Now?

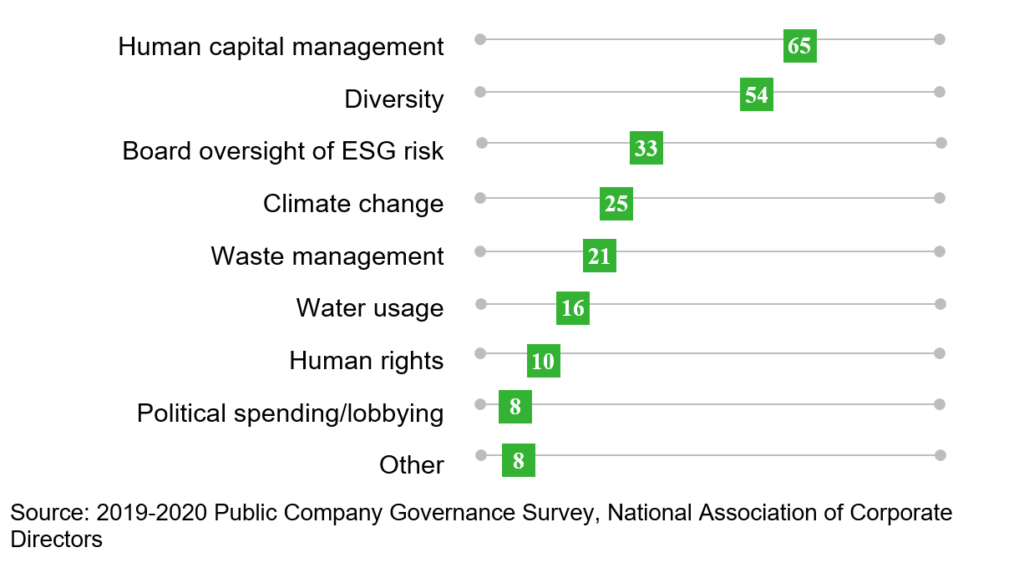

- Review and discuss the linkages between the corporate strategy and ESG-related risks and opportunities (see the chart below for results of the ESG-related issues creating the greatest concern among surveyed companies).

- Review your board’s ESG oversight structure, including whether a specific committee has been delegated primary responsibility to oversee the company’s overall ESG efforts, and, if so, consider moving ESG oversight to the full board level. As noted above, separate committees may also be delegated specific oversight responsibilities as appropriate.

- Consider how the board and committees will remain focused and coordinated on ESG issues. Continue to educate directors on ESG matters and ensure the board’s and committees’ approach to ESG aligns with the company’s ESG efforts and overall strategy.

- Review and update committee charters and proxy statement to disclose to shareholders and other stakeholders how the board has delegated ESG oversight responsibility. As an example, BlackRock expect boards to oversee human capital management and to disclose their approach, actions and progress towards achieving diverse representation on the board.1 Ensure that the company communicates a cohesive message on the board’s approach to ESG that aligns with the company’s purpose and strategy, as well as shareholders’ interests.

ESG-Related Issues Causing the Greatest Concern to the Companies (Percentage of Board)

- BlackRock Investment Stewardship: Proxy voting guidelines for U.S. Securities (effective as of January 2021), available here; BlackRock, Our approach to engagement on board diversity – Investment Stewardship, available here.≈